Updating Tax Withholding via eSignature

An overview of the Tax Unification release and how to prepare your site to utilize it.

OVERVIEW

Tax Withholding Unification is a new Namely feature that automatically populates tax withholding information submitted via eSignature—either during onboarding or at a later date—on an employee’s payroll profile. The feature utilizes both federal and state tax forms, and increases efficiency for payroll administrators while reducing duplicate entry and the risk of errors.

HOW TO GET THE MOST OUT OF TAX UNIFICATION

Tax Unification uses specific, Namely-provided federal and state tax forms that are required for the feature to work. To take advantage of Tax Unification, you’ll need to select the forms from the Namely section of the document dropdown whenever you want the entered withholding information to populate on an employee’s payroll profile. Additionally, you may need to update your onboarding templates to make use of these compatible forms.

Depending on how you are currently tracking withholding information and managing requests to change it, you may also need to review your organization’s profile fields and workflows.

We’ve outlined the next steps for getting the most out of tax unification below.

Adobe eSignature

In order to take advantage of W-4 Tax Unification, you must have Adobe eSignature integrated with your Namely site. For detailed instructions see How to Set Up the Adobe/Namely eSignature Integration.

Federal W-4 Forms

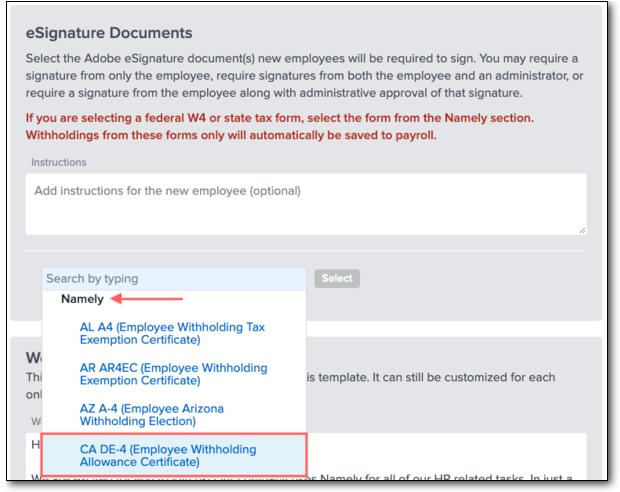

Only the Namely-provided federal W-4 forms will work with Tax Unification. Namely-provided forms can be found in the Namely section of the document dropdown menu in onboarding and Manage eSignature.

-

Note: The Namely-provided Federal Form W-4 will automatically update to the latest version annually, both in onboarding and Manage eSignature, so you will always be using the most recent form.

State Tax Forms

Only Namely-provided state withholding forms will work with Tax Unification. If you currently are using your own state forms which you have uploaded to your Adobe eSignature account, you’ll need to start using the Namely provided forms to take advantage of Tax Unification.

-

Note: The Namely-provided state tax forms will automatically update with the latest version annually, both in onboarding and Manage eSignature, so you will always be using the most recent form.

Namely-provided state forms will automatically appear as options to be selected in the Document dropdown in Manage eSignature, and are ready to be used with no other action required. Note that a small number of states do not have their own state tax withholding forms. For more information see What states do not have a tax withholding form?

If you want to use Tax Unification in Onboarding, you’ll need to update your onboarding templates to use the Namely-provided state forms, as outlined below.

Onboarding Templates

If you want withholding information submitted via onboarding to flow onto an employee’s profile, and you currently don’t collect federal or state tax forms during onboarding, or you use your own state tax forms, you’ll need to update your onboarding templates to use federal and state forms that are compatible with Tax Unification.

For instructions, see Editing Published Onboarding Templates.

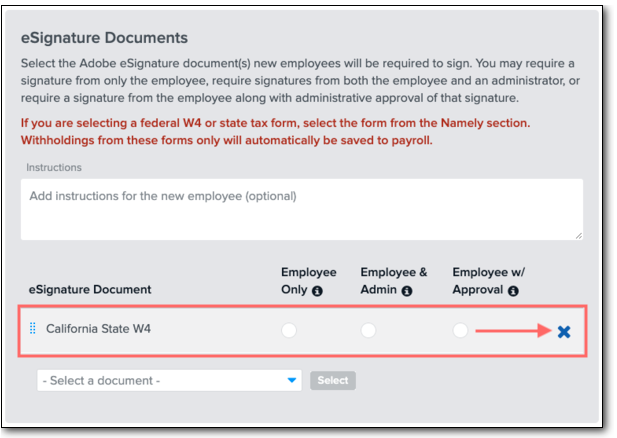

If you need to replace your own state tax forms with compatible forms in the eSignature section of the template, delete any state tax forms currently in the template.

Select new state withholding forms from the Namely section of the document dropdown. If you need to, you can also add the Namely-provided Federal Form W-4 to the template.

When you have finished adding any necessary forms, click Save & Return to Summary.

Custom Profile Fields and Workflows

If you are currently using custom profile fields to track employee withholding information in HCM, please note that they will not be integrated with W-4 Tax Unification. We recommend you deprecate the use of these fields and hide them from view, and instead direct employees to their paystub if they want to review their withholding information.

Additionally, if you currently use workflows to allow employees to request changes to custom profile fields that track tax withholding information, we recommend you deprecate these workflows along with their custom profile fields.

If you would like to continue to allow employees to request changes to their tax withholding information via a workflow, we recommend creating a new custom profile field and workflow:

-

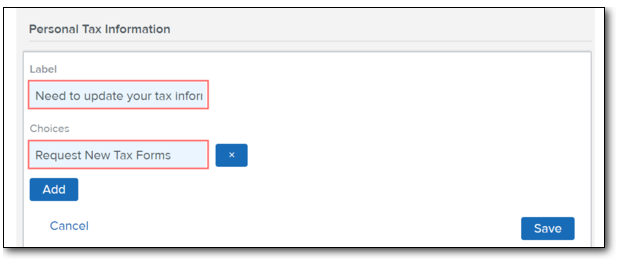

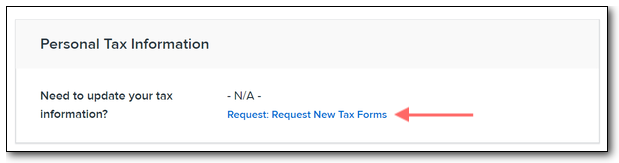

Under Company > Settings > Profile Fields, create a new profile field with the following attributes:

-

Label: “Need to update your tax information?” (or something similar)

-

Type: Select

-

Choices: “Request new tax forms” (or something similar)

-

-

Under Company > Settings > Field Group Bundles, give employees Request privileges for the new field on their assigned field group bundle used for workflows.

-

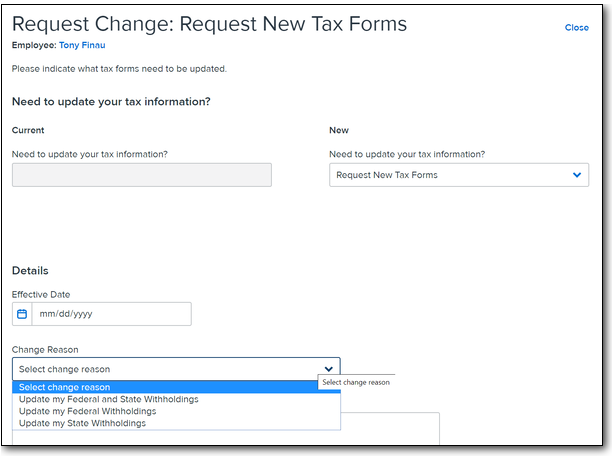

Under Company > Settings > Change Reason Sets, create a new change reason set with the following attributes:

-

Reason Set Name: “Tax Updates”

-

Reasons:

-

“Update my Federal and State Withholdings”

-

“Update my Federal Withholdings”

-

“Update my State Withholdings”

-

-

-

Under Company > Settings > Workflow Editor, create a new workflow template around the new custom profile field and change reason set.

After the workflow template is published, employees can launch it from their profile, and administrators can send them the requested tax forms via Manage eSignature so they are published on their profile.

For more information on creating workflow templates, visit our Creating a Workflow guide.

OTHER ONBOARDING UPDATES

Namely has introduced a number of enhancements to Onboarding in the past year, including:

-

The ability for an onboarder to assign a new hire to a pay group

-

The ability for a new hire to submit their direct deposit information during onboarding (requires onboarder to assign them to a pay group)

-

The ability to upload files, like an offer letter or license/certification, while completing an onboarding session

Since you’re already updating your templates, why not take this opportunity to ensure you’re utilizing onboarding to its fullest? We also recommend assigning Department and Office Location during onboarding to prepare for our upcoming Org Units release.

For more information, visit our Onboarding Templates guide.